Saving for a rainy day is something we have never really done. The hard-earned income that we earn through our jobs is pretty much spent on frivolous expenses, including eating out, entertainment and other essential items. Though there have been countless articles in the newspapers plus financial savings TV shows, we haven’t really given too much importance to save money for the future. How many times have we actually sat down and tried using a retirement calculator, to figure out what will our savings be after 25 years?

Pic Source : https://insideyourira.com/investment-calc-retirement/

Irrespective of the monthly income level, be it 40,000 or 1 lakh or even 2 lakhs, the spending is always proportionate to the earnings. The 20-30% tax deducted from that is equally daunting. So amid all this, it’s imperative that we save a small fraction of that amount (at least 10% as a bare minimum) per month. This will come handy 20-30 years later when you most likely don’t have a fixed income.

Where to Invest?

When you finally decide to invest in a savings plan, you need to figure out which one works out to be the best for you. The most common options include mutual funds, fixed deposits, investing in a home loan EMI (instead of saving actual money), and so forth. There’s also a set of people who smartly decide to invest in pension linked savings scheme provided by a few reputed nationalized banks in India.

ICICI Prudential Life Insurance provides one such reliable savings/retirement corpus scheme through their retirement planning policies. It allows you to use a retirement calculator and helps you in deciding the best retirement plan for you. A scheme ideally targeted for people aged 35 and above; this can come as a perfect blessing while planning a stable and secure future. Knowing that you’ll be receiving a fixed monthly income or a hefty amount while at the time of retirement, itself can be a major relief for a lot of people. It takes away all the stress, anxiety and worry that comes with thinking about the future.

The ICICI Retirement Planning Calculator

- Head to the retirement calculator page : https://www.iciciprulife.com/insurance-guide/financial-planning-tools-calculators/retirement-planning-calculator.html

- Set the slider to your current age (Should be 35+). You can either keep the default retirement age upto 60 years or modify it by a few years up or down.

- The most important step is to enter your monthly income. This should be ideally the final income in hand (post taxes) and not your net CTC. The % from this amount would finally be your basis for calculating your post retirement income in a retirement calculator.

- Enter a reasonable % for annual savings for retirement.

Let’s assume your annual income is 12 Lakhs (1 Lakh/month).

So if your age is 35, the retirement age is set to 60, and annual savings % is 10 %.

This means your retirement corpus after 25 years will be more than 71 Lakhs INR (with an assumed rate of 8%) and 42 Lakhs INR (with an assumed rate of 4%).

Interestingly half of American Millenials have already dipped into their pension fund to repay excessive college loans, debts, to buy a house or even pay for their medical expenses. To read more, click here.

Though Govt provides a national pension system scheme, the rate of income and % interest is much lesser compared to the privatized nationalized banks.

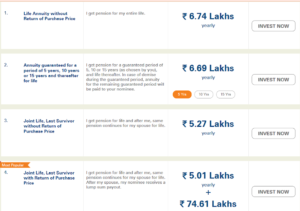

ICICI Prudential offers several pension and payout schemes that you can choose from, based on whether you focus on a payout or a fixed monthly income for life. The benefit of these savings plan may be realized only when our usual income stops and realize how every penny we had saved will come in handy decades later. So even if not a lot, invest whatever you can in a good savings scheme and secure your future and your future generations.

For example, the most popular scheme featured is the : Joint Life, Last Survivor with Return of Purchase Price. This gets you pension for life (5 Lakhs a year) and after you, same pension continues for you spouse for life. After your spouse, your nominee receives a lump sum payout (74 Lakhs).

The benefit of these savings plan may be realized only when our usual income stops and realize how every penny we had saved will come in handy decades later. So even if not a lot, invest whatever you can in a good savings scheme and secure your future and your future generations.